child tax credit payment schedule 2021

Tax credit payments are made every week or every 4 weeks. Here is some important information to understand about this years Child Tax Credit.

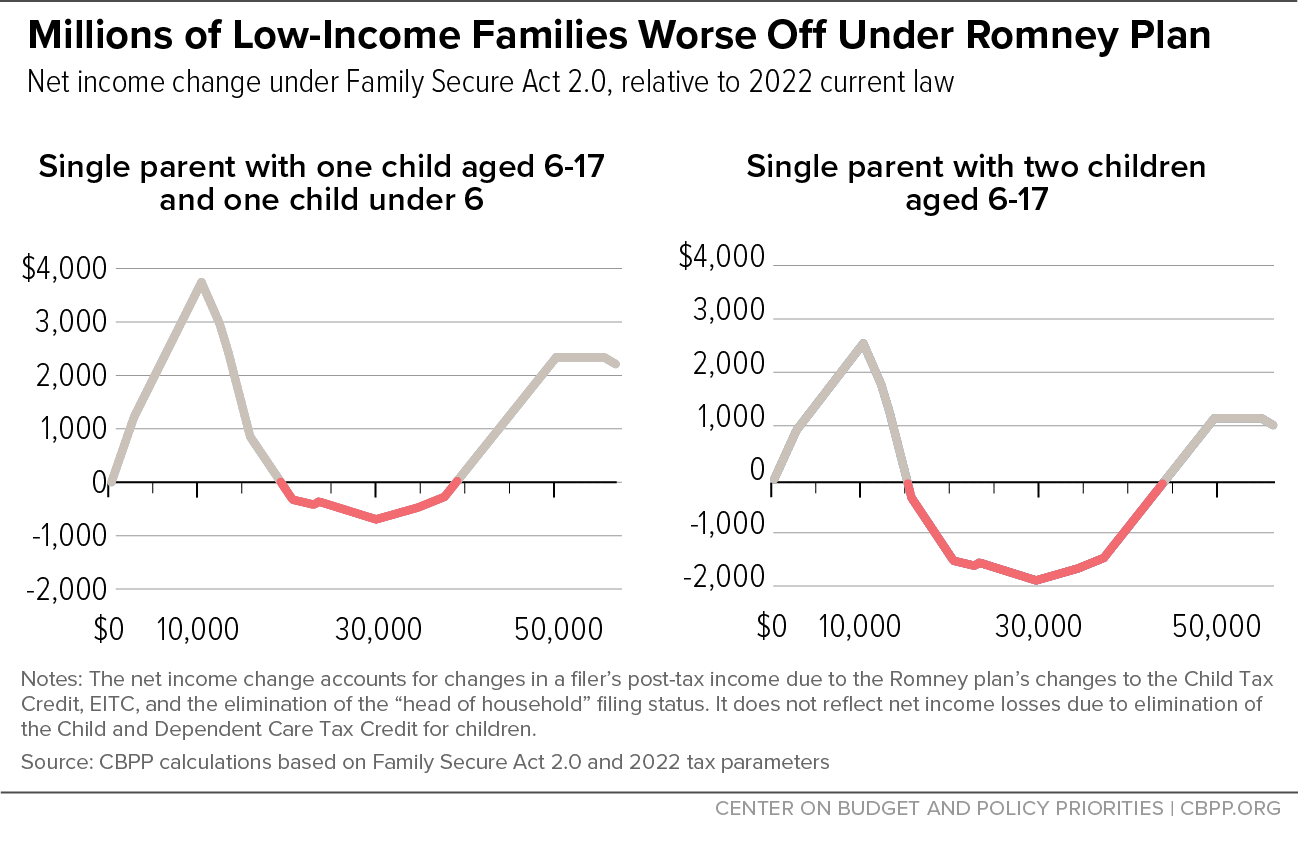

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per.

. October 5 2022 Havent received your payment. What is needed to receive a 1400 payment in 2022. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous.

The Child Tax Credit provides money to support American families. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. 22 rows Find out when your tax credits payment is and how much youll get paid.

The first three payments were made on July 15 August 15 and September 15 with the next to come on October 15. And 3000 for children ages 6. Payments will be made on the same date in November and.

A bigger boost for one year. 15 The payments will be made either by direct deposit or by paper check depending on what. Wait 10 working days from the payment date to contact us.

Get your advance payments total and number of qualifying children in your online account. Within those returns are families who qualified for child tax credits CTC. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

The amount you can get depends on how many children youve got and whether youre. Making a new claim for Child Tax Credit. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll Child Tax Credit Payment.

What is the schedule for 2021. Enter your information on. Depending on your income you must have earned income of at least 2500 to be eligible for the refund.

You choose if you want to get paid weekly or. All payment dates. It also provided monthly payments from July of 2021 to.

Here are the official dates. You may have received a portion of your Child Tax Credit through advance Child Tax Credit payments. The IRS said.

Six payments of the Child Tax Credit were and are due this year. Already claiming Child Tax Credit. Recipients can claim up to 1800 per child under six this year split into the six.

September 19 2021 500 AM Ridofranz Getty ImagesiStockphoto The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36. 3600 for children ages 5 and under at the end of 2021. Schedule 8812 Form 1040 is now used to calculate child tax credits and to report advance child tax credit payments received in 2021 and to figure any additional tax owed if.

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. Under the American Rescue Plan families can receive a credit totaling 3600 for each child under 6 and 3000 for each one under age 18 for 2021. You received advance Child Tax Credit payments for a qualifying child.

For those who have filed state income taxes and claimed a property tax credit for 2021 and are not claimed as a dependent on another return nothing additional is needed to. The IRS says its on schedule to start sending monthly child tax credit payments this summer. To reconcile advance payments on your 2021 return.

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

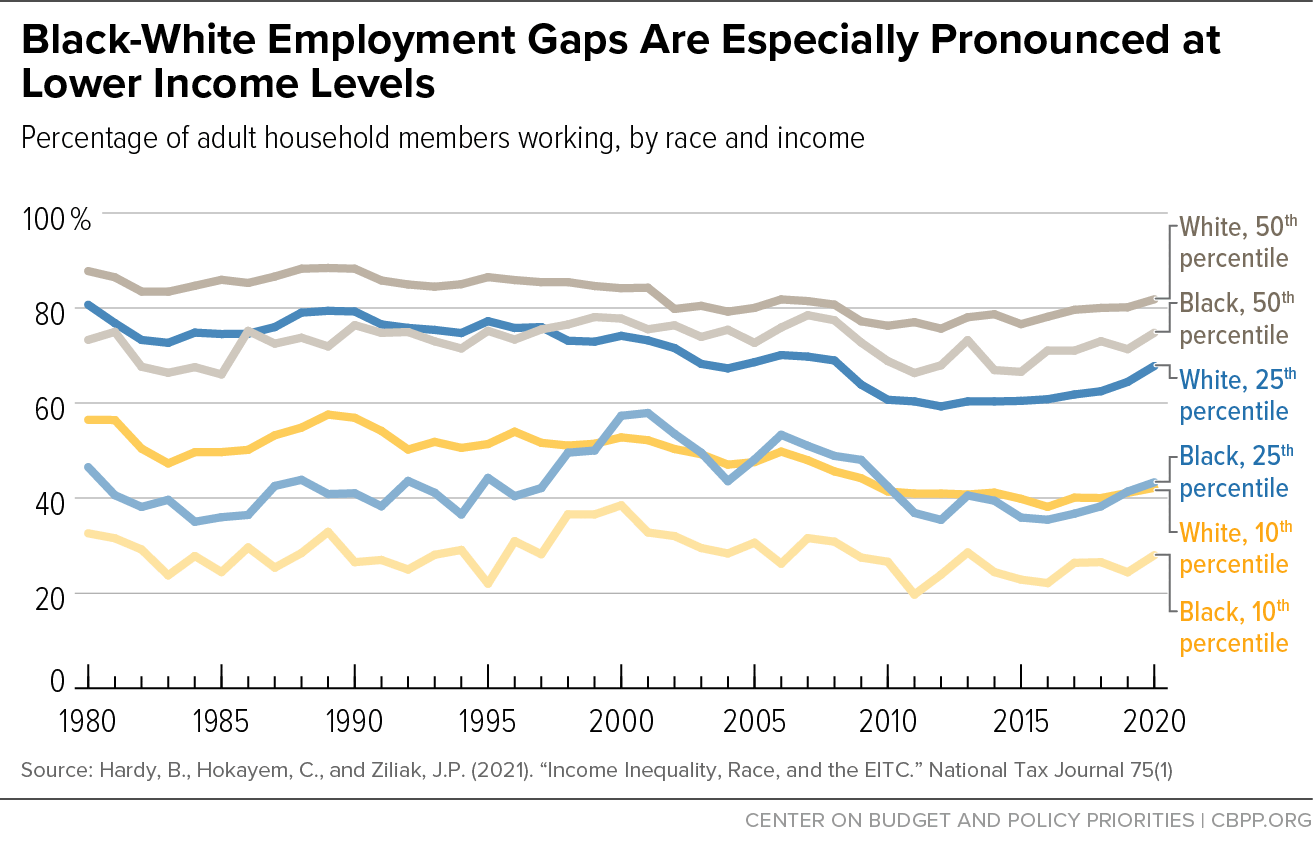

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit Payments Will Start In July The New York Times

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Deadline To Apply For Ct S Child Tax Rebate Is Sunday

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Childctc The Child Tax Credit The White House

2021 Child Tax Credit Advanced Payment Option Tas

Despite Flaws Romney Proposal On Child Tax Credit Creates Opening For Bipartisan Action Center On Budget And Policy Priorities

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet